On many occasions these two terms are confused, or even Crowdfunding is taken as a form of financing in which the characteristics of Crowdlending are included.

The reality is that there are two ways to get money for your projects, but the way to do it differs significantly.

Before analysing the differences between crowdfunding and crowdlending, it is important to know that there are two types of crowdfunding.

The first is the disinterested donation to a project, which is therefore not considered an investment. On the other hand, the second option is the one that comes closest to crowdlending, because it is crowdfunding by which either you invest money to obtain a percentage of participation in a project, or you offer a loan that will later be recovered.

Let’s analyse each of these two disruptive models of the sharing economy separately.

What is crowdlending?

Crowdlending, also known as peer-to-peer (P2P) loans, allows companies to finance themselves through a large and diverse group of people (crowd = crowd, lending = lending money), without having to go to a bank.

In the crowdlending model, people lend small amounts of money to a company in exchange for a financial return established in a loan contract. Actually, crowdlending is the most similar form of financing a bank can provide. Instead of a bank or financial entity, it is a private person or a company that decides to lend you the money, with the conditions established by the parties. The money will be returned together with interest, without the person who lends the money having access to the benefits of the project or, in principle, loses if the plan does not work as expected by its creators. Crowdlending platforms connect lenders with borrowers. They operate with fairly cheap overheads compared to traditional financial institutions and do not charge high fees. P2P platforms also offer significantly higher returns on investments compared to banks and are an attractive alternative (or complement) to stocks, bonds, real estate, and savings accounts.

What is equity crowdfunding?

Equity crowdfunding or crowd equity is a collective financing system in which any person of any social and economic condition, including small investors, can participate in a financing fund to promote a project in exchange for participation in shares of the company or return of money with interest.

Unlike what happens in crowdlending, in this form of crowdfunding the investor will only enter the project to obtain an economic benefit, so if the plan does not work as expected, it is possible to lose all the money invested. In the same way as crowdfunding, equity crowdfunding is very interesting for investors because it is not necessary to own too much capital.

In addition, by being able to make a small investment, the investor will have the option of making more profitable investments in fast-growing startups.

Crowdlending and crowdfunding platforms

Both crowdlending and crowd equity platforms are online entities that connect lenders and borrowers. Loans can be unsecured or backed by real estate, cars or any other property. Interest rates can be set by the platforms or by the lenders themselves. They also schedule payments either in monthly installments or in a global payment at the end of the term. These platforms derive their income from fees charged for financing borrowers’ loans and/or (less commonly) fees charged for servicing investors.

In the following section, we show you two companies, one dedicated to crowdlending and the other to equity crowdfunding, to clarify these disruptive business models.

Capital Cell

Equity Crowdfunding Platform

Capital Cell is a good example of a crowdfunding company. Being a crowdfunding platform of reference in Europe, Capital Cell Spain is a 100% subsidiary of Capital Cell UK specialized in financing new companies in the life sciences sector.

Through Capital Cell, individual investors can participate as shareholders in the financing of startups in the health and biotechnology sectors, which are some of the most profitable sectors in the world. As it does not charge any type of commission to the investor, neither for opening an account, nor for maintenance, nor for incoming or outgoing transfers, it is a “0.0” platform, free of commissions.

On the other hand, the crowdfunding platform offers companies the necessary tools to raise funds as quickly as possible in their financing rounds. The companies specialized in biomedicine that chooses Capital Cell to finance themselves will be able to promote their investment round with the personalized marketing plan offered by the platform itself. The platform guides the startup throughout the investment process.

Moreover, if the round of financing does not result in a success, the startup will cost nothing: Capital Cell only gets paid if the company wins. Although Equity Crowdfunding is the riskiest and potential crowd investment variant, the level of involvement and information provided at each investment opportunity makes Capital Cell a unique crowd equity platform. His team strives to maximize potential returns and minimize risks with its strict screening process, which translates into its immaculate Track Record to date.

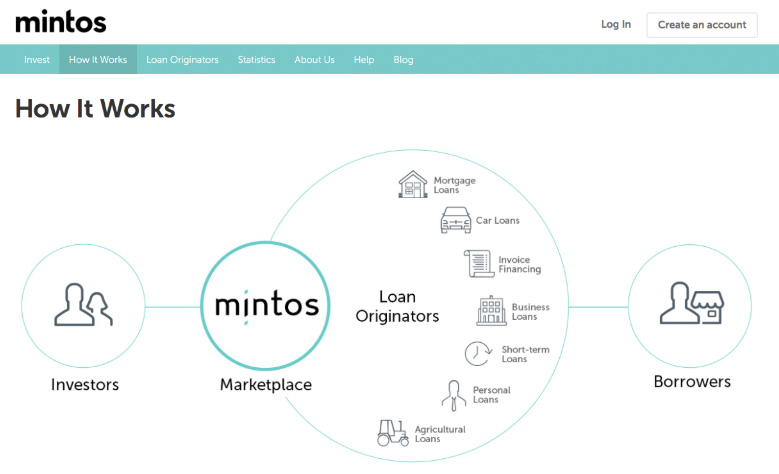

Mintos

Crowdlending Platform

Mintos is a fin-tech company based in Riga, Latvia whose lending platform serves to connect investors with borrowers seeking non-bank financing through peer-to-peer loans via crowdlending. Like other crowdlending platforms, Mintos is easy and transparent financing and investment alternative that is very attractive, which is another option to obtain resources and is born with the aim of competing with traditional bank financing.

Mintos can provide opportunities for both private and institutional investors, from only 10 euros you can make an investment. Moreover, investors can diversify as much as they want their investments all over Europe, as they are currently working in almost all European countries granting all types of loans by means of crowdlending: from mortgage loans to unsecured personal loans.

The functioning of Mintos is very similar to that of all Crowdlending platforms: you enter your data as a promoter or investor. If you are a promoter, you apply for financing and provide the required documentation and if everything is OK, they publish your application in their Marketplace so that investors can invest their funds. If you are an investor, you register an account by entering your email address and your tax details.

You must be over 18 years old, have a bank account operating in the European Union and if you are a company this must be in force with all documentation up to date, have a bank account in the EU and that the administrator is not disabled to exercise the position. Once you transfer the money from your bank account to your Mintos account, you can invest in any Crowdlending operation that you consider interesting.

REFERENCIAS:

https://profitforsaving.com/what-is-crowdlending/

https://www.fundable.com/learn/resources/guides/crowdfunding/what-is-crowdfunding

https://www.thebalancesmb.com/a-guide-what-is-crowdfunding-985100

https://www.finsmes.com/2019/05/what-to-be-aware-of-when-investing-in-crowdlending.html

https://moneybrewer.com/what-is-crowdlending/