No time to read? press play.

It took 9,500 years to reach paper money, and in less than 60 years we have made an unprecedented leap in its evolution, achieving nearly invisible payment.

From gold coins to digital wallets, the payments industry has always evolved. But the reality is that to get to this point, where we have a wide range of payment options, we have gone through a great process of evolution and transformation, as well as an adaptation on the part of the consumer.

In this article, we are going to see the latest advances in payment systems related to new technologies. But first, let’s take a quick look at the timeline of the evolution of payments through history.

Timeline of the evolution of payments

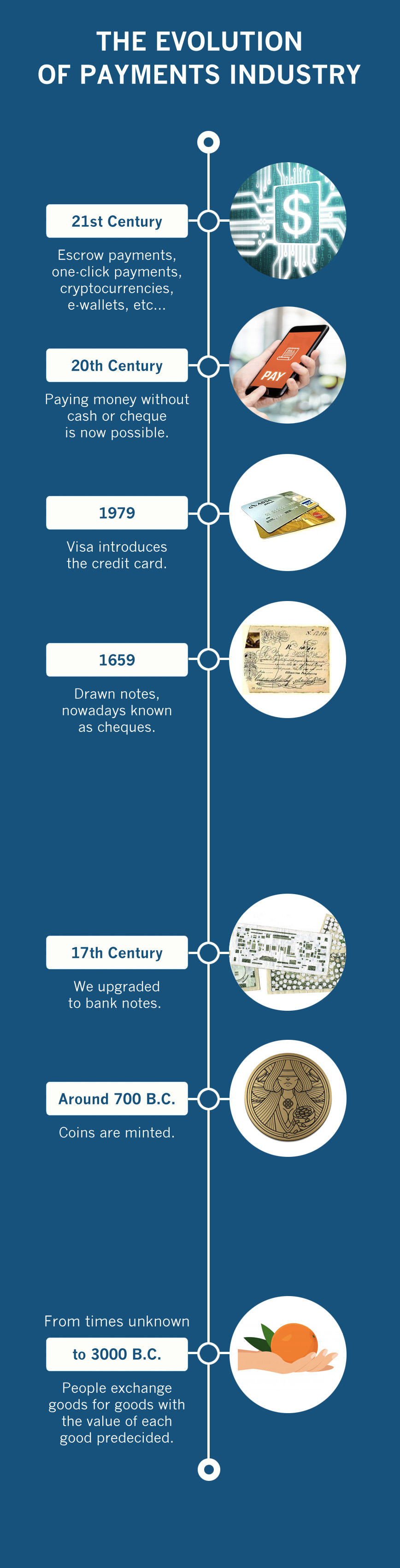

- From times unknown to 3000 B.C.: Payment system is in its nascent phase. The barter system is followed. People exchange goods for goods with the value of each good predecided.

- 3000 B.C.: Barley is used as token money. Payment system now works with commodity money instead of simple barter.

- Around 700 B.C.: Coins are minted. Payment is now distinct coins that hold value.

- 17th Century: Heavy coins have started becoming a menace and we have upgraded to bank notes. This is plain hard cash we still use.

- 1659: Drawn notes, nowadays known as cheques, are introduced by bankers of London for the first time in the economy.

- 1979: Visa introduces the credit card terminal. Although the credit card system is changing into a more dramatic fashion, to a certain degree the Visa’s point of sale is still the most prevalent credit card processing machine used.

- 20th Century: Internet is here, and digital payment along with it. Paying money without cash or cheque is now possible. The system now recognizes you and the value of the cash you own.

- 21st Century: Digital payments have evolved at breakneck speeds. Escrow payments, one-click payments, e-wallets and cryptocurrencies are just a few of the number of new concepts of the current payments industry. Nonetheless, to pay with cash, cheques, and credit cards continues to be one of our daily-basis operations.

Internet or the revolution in the Payments Industry

By the mid-’90s arrival of the internet, new business models arose which demanded a new kind of payment method, one that could meet the need of internet-based businesses. That meant the beginning of the companies known as payment gateways, such as Paypal, Braintree or Stripe Square. They revolutionised not only the evolution of payments, but it also meant a turning point in the e-commerce industry.

A payment gateway is part of the “magic” that occurs in the background when a credit or debit card transaction takes place. By securely sending information between the website and the credit card network for processing and then returning the transaction details from the payment network to the website, it is a major component that allows e-commerce to work.

Electronic payments quickly became the new face of payments and people started to relay on e-payments, thus, making payment gateway a common term. In 1994, Amazon, one of the e-commerce pioneers is founded. One year later eBay is launched and Pizza Hut starts accepting online food ordering. The need for cheap electronic payment acceptance services fostered the evolution of the payments industry.

Invisible Payments

We are always looking for an easier, faster way to complete payment transactions: we started using a barter system, then switched from using cash to personal checks, then to credit cards and now to smartphone apps. Now, trends speak for themselves, and willing to be in control of every aspect of transactions, payment is getting ready to become invisible.

Invisible payments take the physical act of actually paying out of the equation, such as using cash, debit and credit cards. Instead, payments are triggered automatically, without the customer having to do anything. To put it simply, you use a service and walk away without paying manually.

The main benefit of invisible payments is that they ensure the automatic processing of the payment in the background. The user is charged through third parties or branded mobile apps that store customer card details on the cloud.

The invisible payment capability ensures that consumers do not have to carry cash or a credit/debit card. They will have a virtual wallet based on the cloud. The customer experience is more fluid than ever, as a single click or the touch of a screen guarantees the consumption of services and products.

Even though this method already looks like a hassle-free payment method, the foreseeable future expects it to spread its roots to an era of revolutionary invisible payments where payments will further fade into the back of the consumer’s mind.

truust.io offers several solutions as a payment partner to businesses at any size. For more information, get in touch with our team.

The growing emphasis on the consumer experience will continue to drive payment innovations. Companies like yours will increasingly realize the importance of moving collections to these platforms, as it will be a differentiator to your competitors. Here are the main three invisible payment methods that are revolutionizing the e-commerce world:

Escrow Payments

Thanks to an API escrow, payments when purchasing products from certain Marketplace can be made with an escrow account in between. For example, in internet shopping, this ensures that the item will be delivered correctly and that it will be charged when the buyer receives it.

The money is not transferred to the supplier’s account until the product or service reaches the buyer correctly. Signing an escrow contract is the ideal formula for both private sellers and companies to ensure collection. In addition, last-minute changes are avoided, as the price originally agreed is already deposited in the escrow account and cannot be changed. On the other hand, the buyer knows that if he does not receive what he has paid for, his money will be returned to him.

The escrow contract, which is a method that is widely used in Anglo-Saxon countries and is spreading rapidly throughout the rest of Europe, has several possible applications and is one of the best current forms of payment.

Split Payments

Split Payment is a method of distributing economic profits between the parties involved in a mercantile operation. The transaction is carried out at the moment in which the client verifies the reception and correct state of the requested product.

At that moment, the concept of escrow comes into play, which represents a key element in this matter. For the Split Payment operation to be properly completed, it is necessary to have a deposit in custody or guarantee that ensures the correct distribution of money given by the buyer.

This escrow account is the best solution to avoid any kind of misunderstanding between the two main parties involved in a commercial transaction. Thanks to it, the buyer is assured that the product he is going to pay for is really what he wants and, on the other hand, the seller knows that the money he is going to receive is real.

Pay by Link

When we talk about Pay By Link we are referring to a method of payment that greatly simplifies the sending and receipt of an economic amount to pay a service or for the purchase of a product.

As its name suggests, it consists of sharing a link through the social network that best suits your needs – whether Facebook, Skype, Twitter, Instagram, mail or WhatsApp among others – and is valid for any model of mobile phone -Android or iPhone-. You can send it by email or include the link in the same budget or invoice.

Luckily for everyone, Pay By Link is not a method that is limited to any specific case, in fact, it is quite the opposite. There are many freelancers who use it to educate their clients in the simplest way possible. This is to facilitate the payment process to avoid delays and other unnecessary problems. It is also used by those companies that are based on their social networks, such as Facebook or Instagram, as they do not have any physical store or any online store.

Conclusion

All that said, we might conclude this article asking ourselves what else can we expect from this evolution-revolution of the payments industry. Perhaps the question the industry is facing isn’t whether or not change will occur; it is which technology standard the industry will embrace as the model moving forward and what that future will look like.